Unlike online fraud, this type of theft is harder to detect because the transaction appears as a regular swipe. The IMF responded by securing the accounts, enforcing multi-factor authentication, and boosting employee cyber awareness. This cyber incident joins the list of latest data breaches that show how a single point of failure can threaten sensitive data. Luxottica agreed to a $250,000 settlement following a data breach that exposed personal and health information of over 829,000 eye care patients in August 2020. The breach stemmed from unauthorized access to an appointment scheduling system and included names, health data, financial information, and Social Security numbers.

Collecting Threat Intelligence

- If your credit card is found on the dark web, change related passwords, report it to your bank, request a new card, and monitor for suspicious activity.

- Early detection is key to stopping criminals before they cause serious damage.

- The breach exposed names and Social Security numbers of affected individuals.

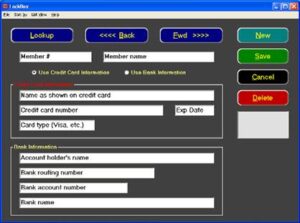

- The card skimmer illegally captures the credentials of cards inserted into the machine.

- Understanding these methods can help you protect yourself and your financial data.

- In June 2025, the ShinyHunters group, tracked as UNC6040, compromised one of Google’s corporate Salesforce CRM instances.

These platforms continuously scour the deep and dark web, looking for any traces of your sensitive information. By setting up alerts, businesses can receive notifications whenever their PII or credit card information appears in suspicious contexts. This proactive monitoring enables businesses to track and investigate potential threats in real-time, helping to prevent fraud before it can impact their operations.

Deep Rock Galactic Fortnite Skins Leaked: Release Date & Prices Revealed

Those who filed may receive money for identity theft losses, time spent dealing with the breach, or flat cash payments. On December 26, 2024, RBFCU, the largest credit union in Texas, reported a data breach affecting over 4,600 customers. The settlement offered compensation to individuals whose Social Security numbers or financial data were exposed. Eligible claimants could receive reimbursements for out-of-pocket expenses and up to four hours of lost time at $20 per hour. All approved claimants were also eligible for two years of free credit monitoring across all three major bureaus. In March 2025, the Pennsylvania State Education Association (PSEA), a labor union representing public school employees, experienced a significant data breach.

16 Billion Passwords Exposed In The Largest Data Breach In The Ever!

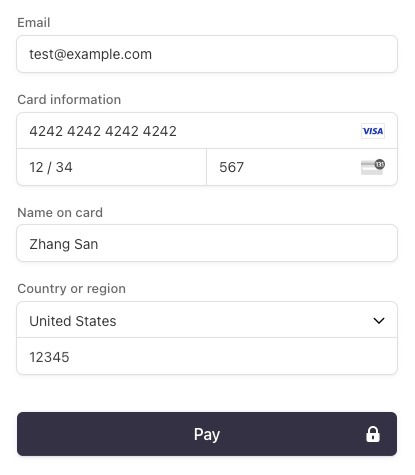

In an e-skimming attack, also known as Web-skimming or Magecart attack, adversaries inject malicious JavaScript code into website payment processing pages to steal payment card details from customers. The malicious code then collects the payment info from users while making purchases on the infected site. Recently, Magecart operators compromised over 2,000 Magento online stores and stole tens of thousands of customers’ personal information.

- BidenCash shop was established in April 2022, following the seizure of other card shops and carding platforms by the Russian authorities.

- A dump of hundreds of thousands of active accounts is aimed at promoting AllWorld.Cards, a recently launched cybercriminal site for selling payment credentials online.

- The IMF responded by securing the accounts, enforcing multi-factor authentication, and boosting employee cyber awareness.

- Anyone who uses credit cards for daily purchases should monitor for exposure to protect against fraudulent transactions and unauthorized access.

- In June 2024, the hacking group IntelBroker claimed responsibility for multiple cyberattacks, including breaches of Apple and AMD.

- One of the most common items sold on the dark web is stolen financial information, including credit card numbers.

Physical cards, on the other hand, are cloned from stolen online details and can be used to withdraw cash from ATMs. These checkers are often offered and sold on the dark web, and are complimentary tools that individuals and organizations use to verify credit card information. The use of JavaScript-sniffers, also known as Magecart, has led to a significant increase in stolen payment card data. Canceling your PayPal account or credit card is a crucial step in preventing further unauthorized transactions.

Intercepting Contactless Payments

Marks and Spencer (M&S) has confirmed a cyberattack that occurred in April 2025, exposing customer data. While payment details were masked and not usable, the breach involved basic contact information, dates of birth, order histories, and possibly reference numbers tied to M&S credit card and Sparks Pay accounts. Some criminals organize stolen card data by ZIP code, according to Novak, “because it makes it harder to conduct fraud detection,” he says.

Stay In Control—Use Privacy Virtual Cards To Mask Your Card Details

Stolen credit cards are used to cash them out or make purchases that can be resold. Many tracker apps link directly to bank accounts for up-to-the-minute info. They show recent purchases, account balances, and spending trends all in one place. Stolen financial info sold online gives scammers instant access to victims’ money.

Bank Sepah Data Breach

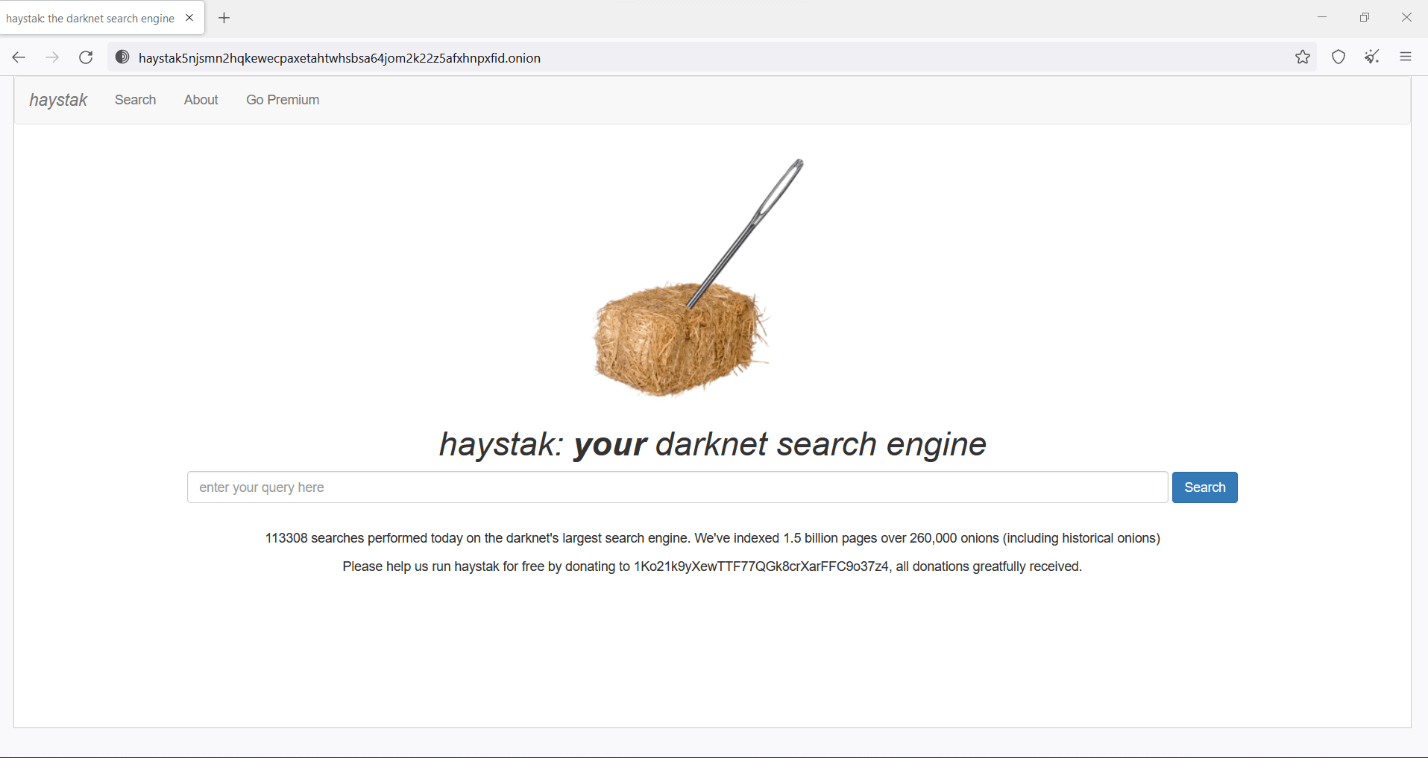

In December 2024, Australian retailer Stan Cash suffered a data breach that exposed customer payment details, including credit card information, names, email addresses, and billing and delivery addresses. The breach remained undisclosed for a year, leading to fraudulent charges on customer accounts. Well, it is mostly misused by attackers for their criminal activities or it ends up on the dark web for sale. Cybercriminals often use the stolen financial data to make fraudulent purchases online or to compromise other accounts via credential stuffing attacks. Most scammers obtain credit card numbers and other financial data from various darknet forums. This article explains how attackers obtain financial data, what happens to stolen data, and how do criminals sell stolen credit card details on the dark web.

Config files are used to specify the parameters and function of a larger automation framework. The “special event” offer was first spotted Friday by Italian security researchers at D3Lab, who monitors carding sites on the dark web. Most companies will reverse unauthorized charges if reported in a timely manner. Thieves install skimmers (devices that read card data) and shimmers (tiny chips that steal data from newer EMV cards) on ATMs or gas station card readers. These devices capture your card’s information without you even knowing. Skimming is a common type of credit card hacking, where thieves attach a device to an ATM or card reader to capture card information.

This makes it crucial to monitor accounts closely and use strong security measures. Dark web credit card fraud poses serious risks to consumers and businesses alike. The data posted on these online illicit shops is a goldmine for threat actors who are looking to commit financial crimes. It provides them with valuable information needed to carry out a variety of attacks.

Google Confirms Salesforce Breach Affecting 255 Million Business Contacts

There’s a wealth of information shared among carders—from how to bypass anti-fraud systems to practical guides on using stolen credit cards—all of which helps keep the ecosystem active and evolving. Large-scale data breaches at retailers, financial institutions or other companies can expose millions of customers’ credit card numbers to hackers. In July 2024, Holt Group, a machinery and construction company based in Texas, reported a data breach affecting 12,455 individuals.

BidenCash Criminal Market Releases Over 2M Credit Card Numbers Free For The Taking

In January 2025, UK telecommunications company TalkTalk investigated a data breach after a hacker known as “b0nd” claimed to be selling data of approximately 18.8 million customers. Dutch cybersecurity firm EclecticIQ attributed the attacks to groups UNC5221, UNC5174, and CL-STA-0048. Attackers deployed web shells, reverse shells, and malware such as PlugX, KrustyLoader, SNOWLIGHT, VShell, and GOREVERSE. An exposed server tied to the campaign contained event logs and targeting lists, revealing both compromised assets and future plans. The Fars news agency reported that the attack targeted the bank’s infrastructure, disrupting online services, though officials expected to restore full service within hours.

Yes, you should be concerned if your credit card number is found on the dark web as it puts you at a higher risk of fraudulent transactions and financial theft. However, being proactive by cancelling the compromised card, monitoring your financial statements, and setting up alerts can mitigate the risks. The first step you should take is to contact your bank or credit card issuer immediately. Inform them that your card information has been compromised and discuss the best course of action, which could include canceling the compromised card and issuing a new one to prevent fraudulent transactions. The dark web is a hidden layer of the internet that isn’t indexed by regular search engines and can only be accessed using special software like Tor. While it has legitimate uses, many illegal activities also take place there.

We’ll explore the latest trends, analyze the impact on businesses and consumers, and discuss the evolving landscape of cybersecurity. In one instance, the team found an ad that asked for $5,000 for access to an unnamed corporate network. Another asked for $2,500 for VPN credentials to a Korean company with an estimated $7bn revenue.