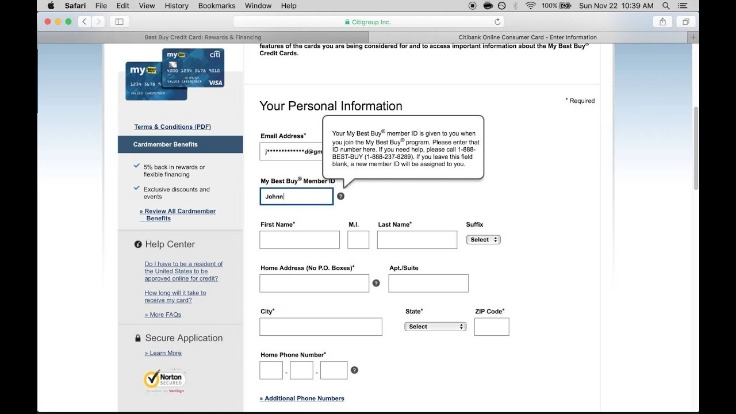

The most common ones target e-commerce websites through phishing attempts and data breaches for this purpose. Other ways include installing skimmers at ATMs and other sources of card swiping. Recent studies reveal that 63% of U.S. credit card holders have been victims of fraud, and over 50% experienced it more than once. With data breaches happening more frequently, your credit card details could already be circulating on the dark web—without your knowledge.

Beef Up Your Online Security

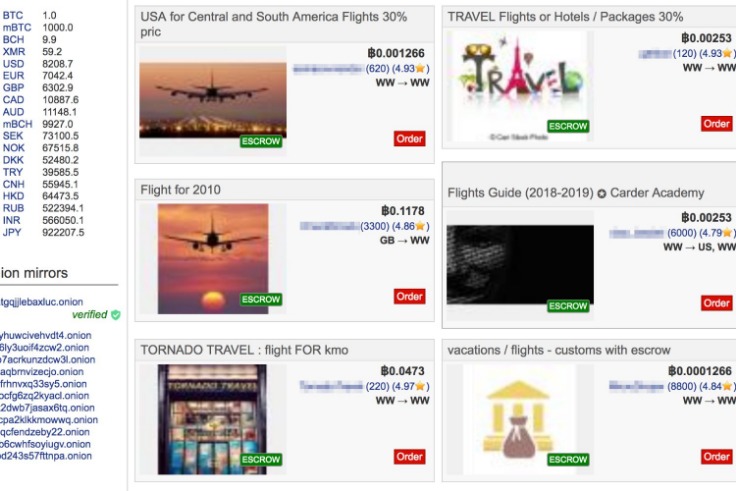

While credit cards have undoubtedly revolutionized the way we make payments, they too have fallen prey to the nefarious activities that thrive in the depths of this digital underworld. This article will explore credit card theft on the dark web, explain how criminals obtain and use stolen data, and explain how to detect and prevent credit card fraud. Stolen credit cards are often used to make purchases at specific sites that don’t have protections against fraud. Card Shops typically host the trade of credit cards and other stolen financial information, making it easy for cybercriminals to find what they’re looking for. It is essential to understand that participating in credit card transactions on the Dark Web is illegal and unethical. Engaging in illegal activities can lead to severe legal repercussions, including fines and imprisonment.

Detecting Dark Web And Deep Web Credit Card Fraud

These stolen cards can be used for financial gain through unauthorized charges, account takeover, and identity theft. So, if you are curious about the mechanics of the Dark Web and how credit card transactions take place in this hidden realm, read on to discover the secrets of this nefarious underworld. Although there’s a variety of goods to be purchased on the dark web, one of the most sold resources by volume on the dark web, if not the most sold commodity, is stolen credit cards. Just last week, the largest carding site operator announced they would be retiring, after allegedly selling 358$ millions worth of stolen cards. Be cautious when making online transactions, especially when it comes to sharing credit card information on the dark web. Carefully vet the websites and online platforms you use for purchases and ensure they have secure payment methods, such as encrypted connections and two-factor authentication.

Protective Measures And Precautions

Kim Komando hosts a weekly call-in show where she provides advice about technology gadgets, websites, smartphone apps and internet security. Credit card details with balances up to $5,000 go for $110, and online banking logins with $2,000 or more go for $60. Actual or formally correct ID card numbers are among the most expensive goods on the dark web. It has built a reputation for being a reliable source of stolen credit card data and PII. Renowned for its extensive inventory of financial data and sophisticated operating methods, Brian’s Club is a key player in the underground economy of financial cybercrime.

How A PayPal Account Or Credit Card Ends Up On The Dark Web

MFA and strong password requirements will force your employees to use strong passwords and change them often. The phrase “dark web” conjures images of illegal activity, but it simply refers to the encrypted part of the Internet that isn’t indexed by search engines. Only accessible by a specific browser, the dark web keeps traffic anonymous. Unfortunately, as NordVPN notes, short of abstaining from card use, “there is little users can do to protect themselves from this threat,” the company said in the release. NordVPN found three times more of its cards targeting affluent customers were hacked compared with prepaid offerings designed for people of more modest means. Credit card prices also vary depending on the brand, with American Express being worth the most at 5.13 cents per dollar.

Information in the listings was entered into a spreadsheet for data analysis and statistical calculations. The technique is very profitable in its own right, but it is also used to help launder and cash-out cryptocurrency obtained through other types of cybercrime. Yale Lodge – the largest dark web vendor of stolen credit cards – has suffered a mass exodus of both customers and stolen data suppliers after apparently stealing their funds.

While it has several legitimate uses, it is also known as the marketplace for illicit activities. Leaking credit card credentials has become a very common phenomenon on chat applications, particularly Telegram. In fact, the overwhelming majority of leaked credit cards in past months originate from Telegram channels. Carding groups and channels reach up to tens of thousands of members, as they are easy to navigate and readily accessible.

Due to its extensive inventory and reputation for reliability, Brian’s Club has maintained a significant presence on the dark web. Quality and validity of the data it provides justify its higher cost over other marketplaces. The platform’s popularity continues to grow, attracting both new and returning customers. I can’t say for certain, but I’ve always seen carding as a more ‘hardcore’ form of cyber crime—at least from a criminal’s perspective.

Quick Report: Credit Cards Sold On The Dark Web In 2021

By regularly checking your credit reports and statements, you can quickly identify any unauthorized charges or suspicious activity. Look out for unfamiliar transactions or sudden changes in your credit score. If you notice anything unusual, contact your credit card company immediately to report the issue. Imagine entering a dimly lit room, filled with whispers and secrets, where the boundaries of legality blur into obscurity. This clandestine realm is none other than the infamous Dark Web, a hidden corner of the internet that has become a breeding ground for criminal activities and a hotbed of illegal transactions.

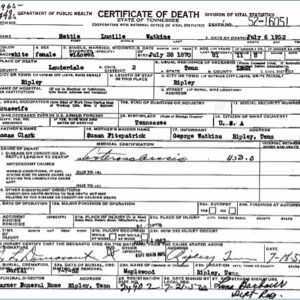

Identity Theft

A computer is able to “make thousands of guesses a second,” Briedis said. “After all, criminals don’t target specific individuals or specific cards. It’s all about guessing any viable card details that work to sell.” In addition to PayPal account balances, they can also transfer money from any connected bank accounts or credit cards. On top of all that, they could make purchases or request money from contacts listed in the PayPal account. These stats highlight the scale of credit card fraud on dark web markets. The threat actor’s marketing strategy involves leaking a large number of credit cards to attract potential clients from hacking and cybercrime forums.

Active buyers are also eligible for free gifts and dumps depending on their volume. Criminals in these cases will attempt to secure the ransom payment after data has already been stolen and put up for sale on the dark web, according to Mr Foss. Free VPNs are often not trustworthy and could put your online privacy and security more at risk. It would help if you used a paid VPN from a reputable provider to ensure the best protection for your credit card information.

When possible, using a credit card instead of a debit card is a good move too. As data breaches become more common, and scammers grow more sophisticated, this is a reality many people are having to contend with. While SSN, name, and DOB are all fairly standard in fullz, other information can be included or excluded and thereby change the price.

- Operating as shadowy corners of the internet, dark web credit card marketplaces facilitate the buying and selling of stolen payment cards.

- The leaked data from the BriansClub hack showed that stolen cards from U.S. residents made criminals about $13 to $17 each, while those outside the U.S. sold for up to $35.70, Krebs reported.

- This enables systems to detect fraud based on minute changes in transaction velocity, merchant category patterns, and even the time of day purchases are made.

- In addition to the risk for payment card holders, the leaked set could also be used in scams or other attacks targeting bank employees.

The dark web credit card market represents a significant threat to individuals and financial institutions alike. Understanding its workings is crucial for safeguarding personal information and avoiding entanglements in illegal activities. Regularly review your credit card statements and bank transactions for any unauthorized activity. Many banks offer transaction alerts via SMS or email, which can help you monitor your accounts in real time.